When it comes to investing in cryptocurrencies, you've got a big decision to make: do you want to manage your own assets or use an exchange? It's important to know the ins and outs of handling digital currencies in this fast-paced market. Both approaches have their own set of advantages and drawbacks, and the choice between them ultimately depends on a variety of factors such as security concerns, convenience, and individual risk tolerance.

Today let’s talk all about self-custody and exchanges. We'll take a deep dive into the different tools, strategies, and considerations involved in choosing between these options. We'll go over the pros and cons of each approach and address any security concerns you may have about using exchanges. By the end, you'll have a better understanding of how to make the most out of your crypto holdings. So let's get started!

What is self-custody?

Self-custody means that you are in complete control of your own assets, like money (cash under your mattress 😜) or digital currencies, without relying on a bank or other institution to hold them for you. In cryptocurrency world, one of the main arguments in favour of self-custody is the enhanced security and privacy that it offers. By holding one's own private keys, investors can ensure that they have full control over their assets and are not reliant on the security measures put in place by a centralised exchange. This reduces the risk of hacking attacks and potential loss of funds due to security breaches.

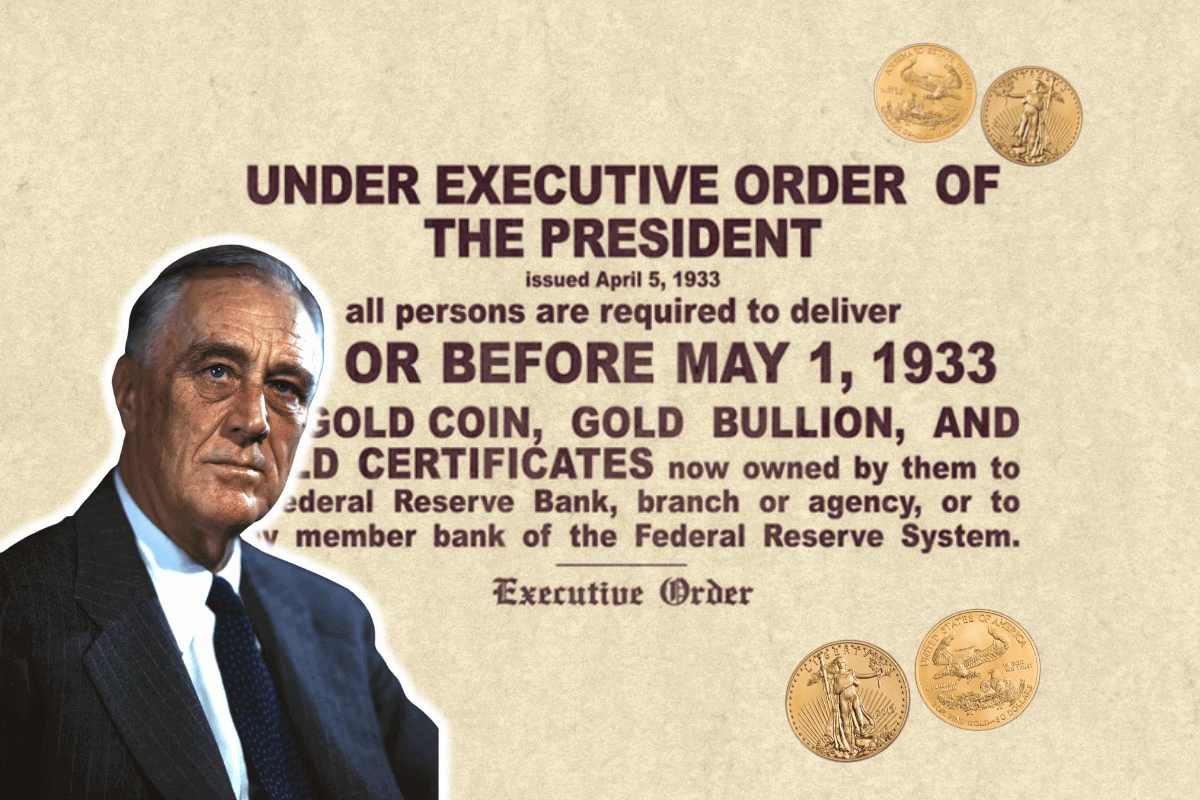

Additionally, by maintaining control of their private keys, investors can also avoid the risk of having their assets frozen or seized by authorities, as was the case in the infamous Executive Order 6102 in 1933, which required US citizens to surrender their gold holdings to the government.

Wait, but what was Executive Order 6102?

In 1933, during the Great Depression, President Franklin D. Roosevelt issued a rule called Executive Order 6102. This rule required Americans to turn in most of their gold—gold coins, bars, and certificates—to the government in exchange for paper money. The Great Depression was a terrible economic crisis. Banks were failing, people were losing their savings, and the economy was in bad shape. The government needed to take drastic action to fix things. At that time, the value of money was tied to the amount of gold the country had. By collecting all the gold from people, the government could issue more money, which they hoped would help revive the economy. Many people were holding onto their gold because they didn't trust banks or paper money. This hoarding meant there was less money circulating in the economy, which made the crisis worse.

By taking control of the gold, the government hoped to restore trust in the financial system. They wanted people to feel confident that their money was secure and that the economy would recover. This gold confiscation was specific to the United States. Other countries faced similar economic problems during the Great Depression, but they used different methods to address them. For example, the United Kingdom stopped using gold to back their money in 1931, which allowed them to handle their economic issues differently.

How does self-custody work?

Normally, you might keep your money in a bank. The bank holds your money, keeps it safe, and allows you to access it when you need it. With self-custody, you don’t use a bank or any other middleman. You keep your money or assets yourself.

In the world of digital cryptocurrencies, like Bitcoin or Ethereum, self-custody usually involves using a digital wallet. This wallet is a piece of software or a physical device that securely stores your digital money. When you own digital currencies, you have something called a private key. This key is like a secret password that gives you access to your money. If you have your private key, you control your assets. If you lose it, you lose access to your money, so it’s very important to keep it safe. With self-custody, you’re responsible for the security of your assets. This means you need to take precautions to protect your private keys.

What is a private key? A private key is a long string of characters (letters and numbers) that allows you to access and manage your cryptocurrency. The private key is used to sign transactions, proving that you own the associated cryptocurrency and have the authority to spend it. If someone gets hold of your private key, they can access and spend your cryptocurrency. Therefore, it’s crucial to keep it secure and never share it.

What are seed words (mnemonic phrases)? Seed words, also known as a seed phrase or recovery phrase, are a set of 12, 18, or 24 randomly generated words that can be used to recreate your private keys. These words are generated by your wallet when you first create it. The seed words act as a backup. If you lose access to your wallet (e.g., if your device is lost or damaged), you can use the seed words to restore your wallet and access your funds. Like private keys, seed words must be kept secure and private. If someone else gets your seed words, they can recreate your wallet and steal your cryptocurrency. You should memorise or write down (on paper) your seed words and store them in a safe place, such as a secure physical location, rather than saving them digitally(on your phone or computer) where they could be hacked.

!!! It’s important to understand the difference between losing your private keys and losing your hardware wallet. If you lose your private keys, you won't be able to access your funds, even if you still have your hardware wallet and seed words. However, if you know your seed words, you can still access your cryptocurrency even if you lose your hardware wallet. As long as you have your hardware wallet seed words, you can always regenerate your private keys and access your cryptocurrency, even if you don't know the private keys themselves.

Just keep your seed words secure and private.

The amazing fact that most people don’t realise is that your brain can be your cryptocurrency wallet. You can memorise your private keys and seed words like you would a poem or a social security number. As long as you remember your private keys or seed words, your cryptocurrency remains on the blockchain, and you can access it anytime, anywhere.

This portability is the greatest advantage of an asset like Bitcoin in times of crisis, political unrest or natural disasters. You can’t easily carry your other assets with you, like property, gold, shares, ownership documents, etc. With Bitcoin, all you need is your brain.

Pros and cons of self-custody

You have full control over your money or assets. No one else can freeze, limit, or take them away from you.

Since you’re not using a bank or a third party, there’s more privacy. Your transactions and holdings are not as easily tracked by others.

You don’t rely on a bank or any institution. This can be especially valuable if you live in a place with an unstable political or financial system or if you prefer to avoid traditional financial systems.

Plus, self-custody empowers you to engage with DeFi protocols, stake your coins, and explore the full spectrum of the crypto universe without restrictions.

Managing your own wallet means shouldering the responsibility of securing your keys and backing up your seed phrases. One wrong move could result in lost funds or irreversible mistakes.

Additionally, self-custody can be less user-friendly than exchange platforms, requiring a bit more technical savvy and caution to navigate successfully.

Wallets and Tools for Self-Custody

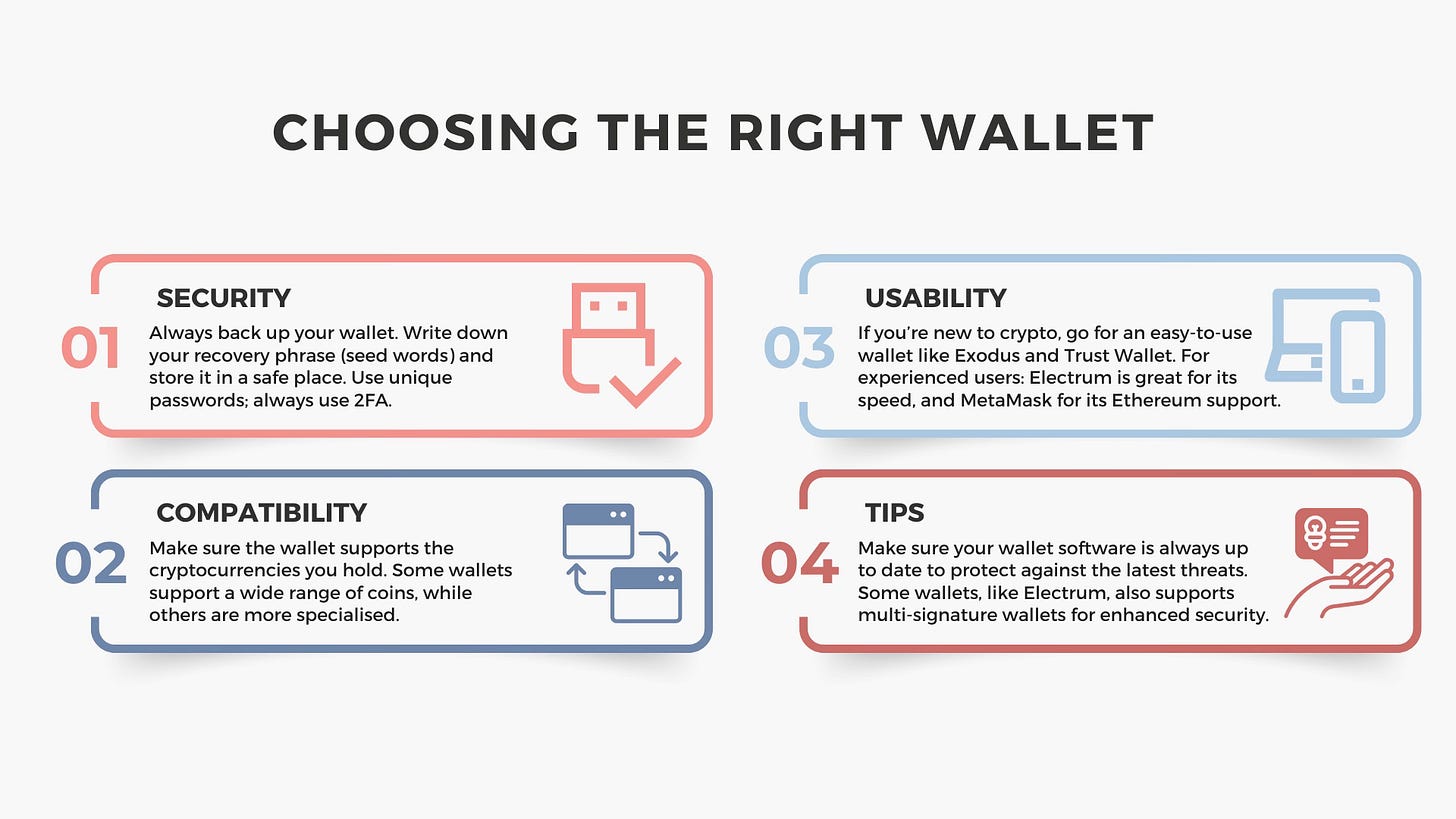

When it comes to self-custody, your trusty crypto wallet is your best friend. Wallets come in various forms, from hardware devices like the Ledger Nano S and Trezor to software options like MetaMask, Trust Wallet, and more. Each type offers a unique blend of security, accessibility, and convenience.

Hardware Wallets

Trezor and Ledger: These little gadgets are like USB sticks you plug into your computer. They're the gold standard for security because they keep your crypto offline, away from hackers. It’s like having a vault that only you can open. These are the best for security. Perfect if you want maximum protection and don’t mind spending a bit for peace of mind.

Software Wallets

Exodus and Electrum: These are apps you download on your computer. Exodus is great if you love a slick and user-friendly interface, while Electrum is super fast and lightweight, perfect for those who appreciate speed and simplicity. These are secure too, but since they’re online, they’re slightly more vulnerable to hacks. They strike a good balance between security and convenience. Electrum also supports multi-signature wallets. You can set up a wallet that requires multiple signatures to approve transactions, adding an extra layer of security.

Mobile Wallets

Trust Wallet and MetaMask: These are apps for your phone, making it easy to manage your crypto wherever you go. Trust Wallet supports a wide variety of coins, and MetaMask is ideal for anything Ethereum-related.

Paper Wallets

Benefits and Drawbacks: This method involves writing down your crypto keys on paper. It’s incredibly secure because it's offline, but if you lose that piece of paper or it gets damaged, your crypto is gone forever.

Beyond wallets, self-custody enthusiasts can tap into a wealth of tools and resources to fortify their crypto journey. From multi-signature setups for added security to decentralised finance (DeFi) platforms for earning passive income, the self-custody toolkit is vast and ever-expanding.

Custody on centralised exchanges

Exchanges play a pivotal role in the world of cryptocurrency. They act as the bridge between traditional financial systems and the decentralised realm of cryptocurrencies. Their importance lies in providing a marketplace for users to exchange different cryptocurrencies and fiat currencies, enabling price discovery and market efficiency.

Custody on centralised exchanges means that when you deposit/buy your cryptocurrency onto these platforms, the exchange takes control of your assets. Essentially, the exchange holds and manages your cryptocurrencies on your behalf. Your cryptocurrency is deposited to the exchange’s wallet.

The exchange typically stores a small portion of these funds in "hot wallets" (online) for easy access for trading, while the majority is kept in "cold wallets" (offline) to protect against hacks. However, this is not the case with all exchanges, and you may find that your crypto is on hot wallets at all times.

The exchange manages your private keys. This means you don’t directly control the private keys associated with your crypto assets; the exchange does.

What is a hot wallet? These are online digital wallets and connected to the internet, used for daily transactions and withdrawals. They are more accessible but also more vulnerable to hacks.

What is a cold wallet? These are offline and provide greater security against hacking. Most reputable exchanges keep the bulk of their customers' funds in cold storage.

Pros and cons of custody on exchanges

Using a cryptocurrency exchange can offer you certain conveniences that self-custody doesn’t.

Exchanges typically have user-friendly interfaces, making it easier for you to buy, sell, and trade your assets.

They also often provide extra services like margin trading, lending, and staking, which you might not have access to if you self-custody your assets.

Exchanges can provide higher liquidity, allowing you to quickly buy or sell your assets at market prices. This is beneficial for active traders who need to execute transactions rapidly.

Centralised exchanges are prime targets for hackers because of the large amounts of funds they hold, and there have been many high-profile hacking incidents where investors lost significant amounts of money.

Exchanges can be subject to regulatory changes and government intervention that may affect your access to your funds.

Since the exchange holds your private keys, you are trusting them to manage your assets securely. If the exchange faces issues like bankruptcy or fraud, you could lose access to your funds.

You don’t have direct control over your private keys. This means that while your assets are on the exchange, you are relying on the exchange's security measures and policies.

Not all exchanges are insured to be able to refund you in case of hacks or fraud.

To mitigate these risks, it's essential to choose reputable exchanges with strong security measures in place, such as two-factor authentication, cold storage of funds, insurance against theft, and transparent operational practices. Don’t keep all your crypto assets on one exchange. Consider diversifying across multiple platforms and using self-custody solutions like hardware wallets for long-term storage. You can always opt for a hybrid solution: if you trade frequently, keep some of your funds on centralised exchanges and hold the rest of your cryptocurrency in a cold wallet of your choice.

Best exchanges for long-term Holding (HODL)

When it comes to long-term holding strategies, or as the crypto community affectionately calls it, "HODLing," certain exchanges stand out for their reliability, security, and user-friendly interfaces. Exchanges like Coinbase, Binance, and Kraken are popular choices for investors looking to securely store their digital assets for the long haul.

Coinbase claims that 98% of customer funds are stored offline in cold storage, Kraken stores 95% of deposits in air-gapped, geographically distributed cold storage, whilst Binance uses a multi-tier and multi-cluster system architecture that includes cold storage for the majority of funds. All three exchanges support and encourage the use of 2FA to add an extra layer of security to user accounts and they have various provisions like insurance coverage for funds held in hot wallets up to a certain amount, to protect against cybersecurity breaches.

They all use withdrawal address whitelisting, allowing users to create a list of verified addresses that withdrawals can be sent to, providing another layer of protection against unauthorised transactions. Regular security audits and testing to identify and fix potential vulnerabilities is yet another sign of a mature and secure exchange.

Additional services offered to grow and secure your crypto

Wallet Services:

Secure wallets to store your cryptocurrencies.

Coinbase and Kraken offer custodial wallets, while Binance provides Trust Wallet as a non-custodial option.

Staking Options:

Staking allows you to earn rewards by participating in network validation.

Coinbase: Offers staking for various cryptocurrencies like Ethereum (ETH), Tezos (XTZ), and others.

Binance: Provides a wide range of staking options with flexible and locked terms.

Kraken: Offers staking services for multiple assets, including Polkadot (DOT), Cosmos (ATOM), and more.

Interest-Bearing Accounts:

Earn interest on your crypto holdings.

Coinbase: Offers interest on stablecoins like USDC.

Binance: Has Binance Savings and Binance Earn, allowing users to earn interest on a variety of assets.

Kraken: Provides options to earn rewards through staking rather than traditional interest-bearing accounts.

Educational Resources:

To help users understand how to protect their accounts and make informed decisions.

Coinbase: Offers Coinbase Learn and Coinbase Earn, where users can learn and earn crypto.

Binance: Features Binance Academy for comprehensive crypto education.

Kraken: Provides extensive support documentation and educational resources on its website.

Customer Support:

Responsive customer support to help with any issues or security concerns.

All three exchanges offer various forms of support, including live chat, email support, and comprehensive help centers.

Ultimately, the choice between self-custody and using an exchange depends on your risk tolerance and security preferences. If you prioritise security and value the autonomy of controlling your own private keys, you may opt for self-custody, despite the added complexity and responsibility. On the other hand, if you prioritise convenience and access to additional services, you might be more inclined to trust your assets to a reputable exchange, despite the potential risks involved. It’s important for you to carefully weigh the pros and cons of each approach and make an informed decision based on your own circumstances and priorities.

Until next time, take care and happy hodling!

RESOURCES:

Wallets and Security Tools

Trezor: Hardware wallet for secure offline storage.

Ledger: Hardware wallet for secure offline storage.

Exodus: Software wallet with a user-friendly interface.

Electrum: Lightweight, fast software wallet.

Trust Wallet: Mobile wallet supporting a wide variety of coins.

MetaMask: Mobile and browser wallet, ideal for Ethereum.

Casa: Multi-signature security solutions.

YubiKey: Hardware device for added security.

Bitwarden: Open-source password manager.

Centralised Exchanges

Wallet services for secure storage

Staking options for earning rewards

Interest-bearing accounts for certain cryptocurrencies like USDC

Educational resources through Coinbase Learn and Coinbase Earn

Wallet services for secure storage

Staking services for multiple assets like Polkadot (DOT) and Cosmos (ATOM)

Extensive support documentation and educational resources

Wallet services, including Trust Wallet

Staking options with flexible and locked terms

Binance Savings and Binance Earn for earning interest on various assets

Comprehensive educational resources through Binance Academy

Secure Asset Fund for Users (SAFU) for emergency fund protection

DeFi Platforms - These platforms generally work with all types of wallets, including hardware wallets like Trezor and Ledger.

Aave: DeFi platform for lending and earning interest.

Compound: DeFi platform for lending and earning interest.

Yearn Finance: DeFi protocol for automating yield farming.

REMEMBER TO DO YOUR OWN RESEARCH BEFORE USING ANY TOOLS & PLATFORMS!