Understanding How Money Policies Affect Your Wallet

Reserve Ratio, Quantitative Easing, and Bitcoin’s Solution

Recently, I joined the Orange Hatter Women's Reading Club. It’s not just a reading club, it’s a community of women Bitcoiners discussing current affairs, building friendships and supporting one another in their learning efforts. We started reading The Hidden Cost of Money by Sebastian Bunney, and it’s been fascinating to see how little we often think about the deeper workings of the financial system. In the first two chapters, the author touches on the reserve ratio and quantitative easing (QE), two major tools governments use to manage economies. But what if I told you that these very tools have downsides that led to the creation of something radically different: Bitcoin? Let's see why Bitcoin’s founder, Satoshi Nakamoto, envisioned an alternative to avoid the flaws in our current financial system.

Whilst in the first chapter of the book the author gives us an overview of the current financial system and how we ended up here, the “fun” part starts in the second chapter, with first paragraph stating:

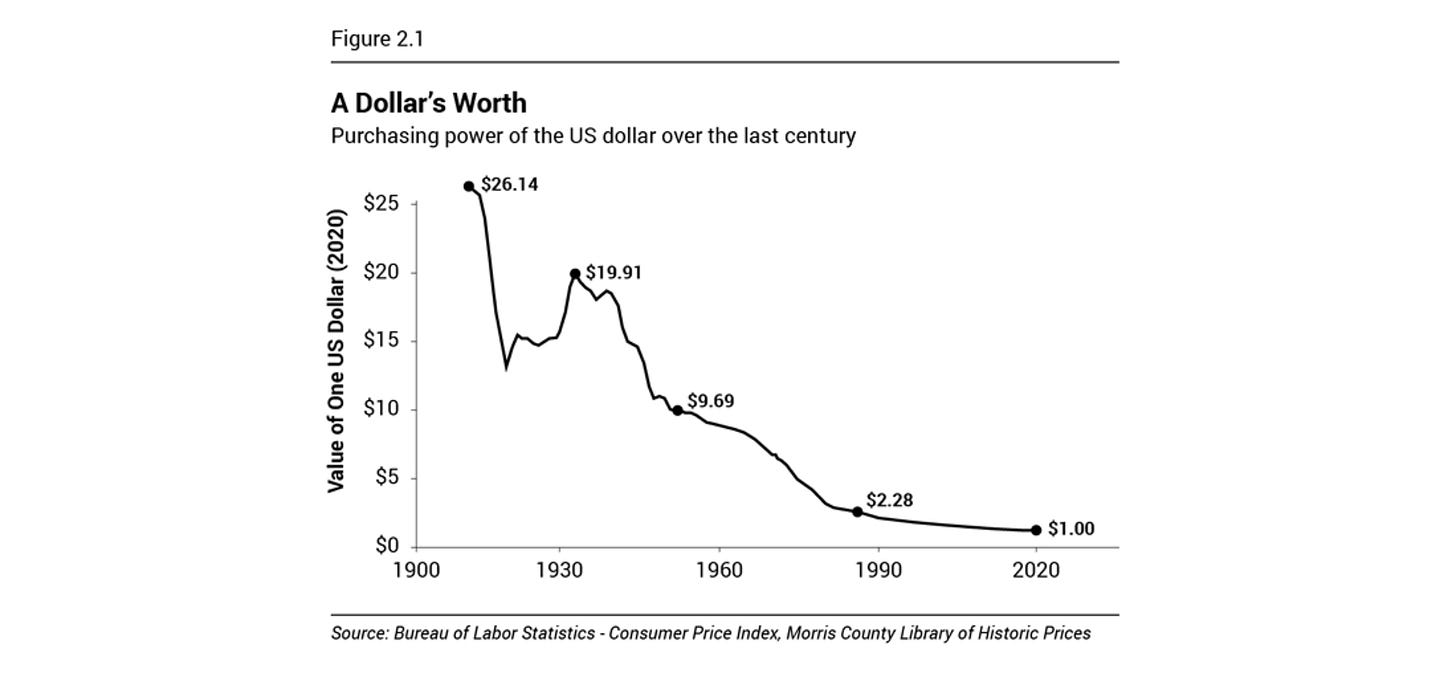

“In the span of a single century, our purchasing power has dwindled by a staggering 96%. The stark reality is that $100 today buys what $3.34 would have purchased a century ago. However, it’s important to note that this loss in purchasing power didn’t simply disappear. Instead, it shifted into the hands of the government and the banks—those with the means to create money—granting them unrestricted control over its use. This loss of purchasing power has created a formidable obstacle, making it increasingly harder for individuals to meet their basic needs, especially those shouldering the responsibility of caring for their children.”

Reserve Ratio: Too Much Lending, Not Enough Stability

What is reserve ratio? It’s the percentage of the total money deposited by customers that banks are required to keep in reserve (either in their vaults or with the central bank). For example, if the reserve ratio is 10%, that means for every £100 you deposit, the bank has to keep £10 in reserve and can lend out the remaining £90. In traditional banking, the reserve ratio determines how much money banks can lend. The problem here is that low reserve ratios, while good for lending and economic growth, can lead to risky lending practices. It’s like if you had a household budget and decided to spend most of your savings, assuming you’d keep getting your regular income. But if something unexpected happened—like losing your job—you’d be left without enough reserves to cover essential expenses. When banks over-lend, it makes the financial system more fragile. The 2008 financial crisis, which influenced the release of the Bitcoin white paper, was largely a result of over-leveraging—banks lending more than they could safely afford, which led to a global financial meltdown when loans couldn’t be repaid.

Bitcoin’s design avoids this problem entirely. There’s no central authority like a bank deciding how much to lend or reserve. Instead, it’s a decentralised system that operates on mathematical proof rather than trust. Every Bitcoin transaction is verified by the network, ensuring no double-spending, and the total supply of Bitcoin is capped at 21 million. This creates a system with built-in financial stability—no risk of over-lending or mismanagement by a central institution.

Quantitative Easing: Pumping Money into the Economy

Now, let’s talk about quantitative easing (QE). This term sounds like something straight out of a finance textbook, but it’s quite simple when you break it down. Imagine the government wants to boost the economy—it’s like giving the economy a big caffeine shot when it's feeling sluggish. In QE, central banks (like the Bank of England or the European Central Bank) create new money. No, they don’t print it like they used to—instead, they use it to buy things like government bonds. By buying these bonds, central banks inject money into the financial system, hoping to encourage banks to lend more, businesses to invest more, and people to spend more.

After the 2008 financial crisis, governments injected huge amounts of money into the economy through QE to encourage lending and spending. While this stimulated growth in the short term, it also increased the money supply dramatically, leading to inflation over time. Think of QE like watering a plant—you want to help it grow, but if you over-water, you might end up drowning the plant instead. In the case of QE, the extra money can cause prices of everyday goods and housing to skyrocket, making life more expensive for all of us.

On the other hand, Bitcoin’s supply is fixed, meaning no central authority can create more Bitcoin whenever they see fit. In a system like Bitcoin’s, inflation is almost impossible because there’s no way to increase the total supply beyond what’s been predetermined. This stands in stark contrast to traditional currencies, where governments can create new money to manage crises, often at the expense of the public’s purchasing power.

The Ills of Centralisation

Both the reserve ratio and QE are centralised financial tools. The problem with centralisation is that it gives a small group of decision-makers enormous control over the economy. Whether it’s determining how much banks can lend (reserve ratio) or how much money to pump into the economy (QE), these decisions are often made to solve short-term problems but can create long-term consequences for society—like inflation, financial crises, and wealth inequality.

How Bitcoin addresses this: Bitcoin was created to be a peer-to-peer electronic cash system, eliminating the need for trusted third parties like banks. In the Bitcoin network, transactions are verified by decentralised nodes through cryptography, not by financial institutions. This means the power to control money no longer lies with central banks or governments but is distributed across a global network. By removing centralisation, Bitcoin avoids the pitfalls of top-down decision-making, reducing the risk of financial mismanagement that leads to crises like the one we saw in 2008.

Why Bitcoin Was Envisioned as a Different System

Bitcoin wasn’t just created as a new form of digital money—it was designed to be a completely different financial system that avoids the very problems caused by traditional banking practices. The reserve ratio, quantitative easing, and other centralised financial tools all have their flaws: they can lead to risky lending, inflation, and instability. Bitcoin aims to solve these issues by using a decentralised network, a fixed supply, and cryptographic proof, creating a more stable and transparent alternative.

In short, while our current financial system is based on trust in institutions, Bitcoin is based on mathematical certainty. It’s a system where everyone can see the rules, and no one can change them to serve their interests, making it a potential solution to many of the issues that have plagued the traditional economy.

Why This Matters for Your Finances

Understanding these financial policies—whether it’s the reserve ratio, QE, or Bitcoin’s alternative—can help you see the bigger picture of how economies work and how money policies affect your daily life. The way governments manage the money supply has a direct impact on things like loan availability, inflation, and the overall cost of living. Bitcoin, by offering a different path, raises important questions about whether the current financial system is really serving society’s long-term interests or just patching up short-term crises.

Stay informed so you can make better financial decisions and understand where the future of money might be heading.

Until next time, keep stacking sats!