Tokenisation: The Future or the Latest Scam?

Cutting through the hype to unveil reality

Tokenisation is one of those buzzwords flying around these past few years, and it’s got people talking about unbelievable returns like it’s the next gold rush. But let’s dig into where it all started. It began around the time when blockchain technology took off in the early 2010s. You know Bitcoin, right? Bitcoin was one of the first successful uses of blockchain. After that, people realised you could use this technology for more than just digital currency—you could represent real-world assets like property, art, and even company shares using digital tokens.

Vitalik Buterin, the founder of Ethereum, played a significant role by creating a platform that allowed people to build their own decentralised apps (dApps). This concept made it possible for anyone to create and trade their own digital tokens (not cryptocurrency) on a global, decentralised network, and that's when the whole tokenisation concept really took shape.

The idea was that by converting assets into tokens, you could make them easier to trade, cheaper to manage, and open them up to more people, and possibly to global markets. But with this came a wave of projects slapping the “tokenisation” label on their plans, whether or not it made sense. So now you’ve got all these promises of effortless riches, but it’s important to see through the hype and figure out where tokenisation can actually help and where it’s just being used to lure investors with empty promises.

Tokenisation 101: What it Really Means

Tokenisation involves taking something of value and creating digital tokens that represent shares in that asset. Picture it like a theatre ticket: the ticket itself isn’t the show, but it represents your seat. Similarly, a token is a digital representation of an asset (real life asset - RAW), like a share in a company or a fraction of a piece of real estate.

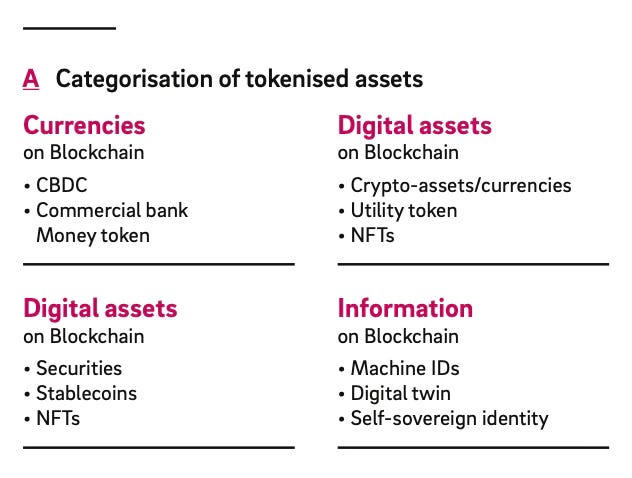

‘Tokenizing' an asset involves creating a digital version of it ('token') that contains all the information and digital rights related to that asset, connected in a programmable and automated way. Tokenized assets can be currencies, equities, bonds, artwork NFTs, and more. - BBVA.com

In many countries worldwide, buying property is considered a safe and stable investment and it is the preferred investment vehicle for people who want to secure their retirement, achieve a good level of financial freedom, or generate passive rental income.

I lived in the UK for well over a decade and the most common investment is buy-to-let properties. Property is traditionally very popular in the UK due to strong historical appreciation and the desire for homeownership. Despite a growing interest in stocks and other investments, property remains a preferred choice for many.

We all know that buying a property outright requires a substantial upfront payment or a mortgage with a large down payment, your investment is tied up in one location and subject to local market conditions, and selling it can take months, with a hefty cost in agent and legal fees.

Tokenising a property would ideally solve all of these issues:

with tokenisation, you can own a smaller share (or "token") of a property, which means you can invest with a fraction of the cost;

it allows you to diversify by investing in smaller shares of multiple properties across different regions or markets, reducing the risk of relying on a single market’s performance;

tokenised properties let you buy or sell your tokens on a marketplace relatively quickly, providing liquidity that outright ownership can’t offer;

you could invest globally with ease, giving you exposure to international property markets.

The Promise vs. Reality of Tokenisation

The Hype: We've all seen the promises: businesses boasting about high returns and the easy liquidity of tokens while name-dropping ‘blockchain’ like it’s a magic word. Some ventures have no real connection to crypto yet use the buzzword ‘tokenisation’ to lure in investors.

The Reality: There are real-world use cases where tokenisation has helped. For example, platforms like RealT allow investors to buy shares (tokens) in rental properties, making property ownership accessible to more people. Similarly, Maecenas uses tokens to allow fractional investment in expensive artwork. The concept is sound when implemented carefully.

The AnnA Villa in Paris made history as the first property in Europe to be fully sold using blockchain technology. Here's how it worked:

This luxury building in Boulogne-Billancourt, valued at €6.5 million, was sold to two French real estate companies. First, they transferred ownership of the building to a joint-stock company called SAPEB AnnA. The company was then divided into 100 digital tokens, which were shared among the new owners. Each of these tokens can be split into 100,000 smaller parts, meaning that people could buy a piece of the building for as little as €6.50.

The sale was managed by a French blockchain platform, Equisafe, and used the Ethereum blockchain. This deal shows how blockchain technology can make real estate investment easier and more affordable, allowing people to buy and sell smaller shares of valuable properties.

In 2019, Blockimmo announced the successful tokenisation of their first Swiss property on the blockchain, located in Baar, Zug, with a total trade volume of around CHF 3 million ($3.2 million USD). This pioneering transaction, facilitated through Blockimmo's platform and supported by Elea Labs and Swiss Crypto Tokens, allowed four investors to own shares in the property via digital tokens, which represent about 20% of the property's value. Learn more

Another example of real estate tokenisation is a luxury Manhattan condo development that was tokenised on the Ethereum blockchain, offering fractional ownership through digital tokens. These are just a few examples showcasing what’s possible with tokenisation. I chose real-estate because most people are familiar with this type of investment, but tokenisation can apply to any real world asset.

Limitations of Tokenisation

Legal challenges: Laws around securities (financial investments like shares) vary greatly between countries, and tokenisation often runs into regulatory issues because it's so new. Navigating these laws can be a minefield, especially if you’re thinking in buying tokens from a different legal jurisdiction than the one you’re residing. The laws around crypto and tokenisation are still being worked out, so things could change, potentially affecting your rights as a token owner.

Technological constraints: Although blockchain can securely track transactions, networks can become congested, leading to delays and high transaction fees. Security vulnerabilities can also pose risks. Problems with the smart contracts (automatic digital agreements) or the trading platform itself could lead to issues with your investment.

Market immaturity: Many people are still learning about blockchain, so awareness and trust in these systems are limited. Without mainstream adoption, projects may struggle to get the momentum needed to succeed.

Market volatility: Just like regular cryptocurrencies, the value of your property tokens can go up and down a lot, which means you could make or lose money quickly. Sometimes, people can manipulate token prices to make them artificially high or low, which could cause you to lose money.

Liquidity risks: It might be tricky to sell your share of a property if the market doesn’t have enough participants, aka: buyers and sellers.

Fraud risks: Decentralisation (no central authority controlling the network) is great for security but can also enable scams, as many unverified projects slip through the cracks, taking investor money with them. Like with any other investment, it’s good to make sure you know where you’re investing and why.

Solutions and a Probable Future

Possible Solutions:

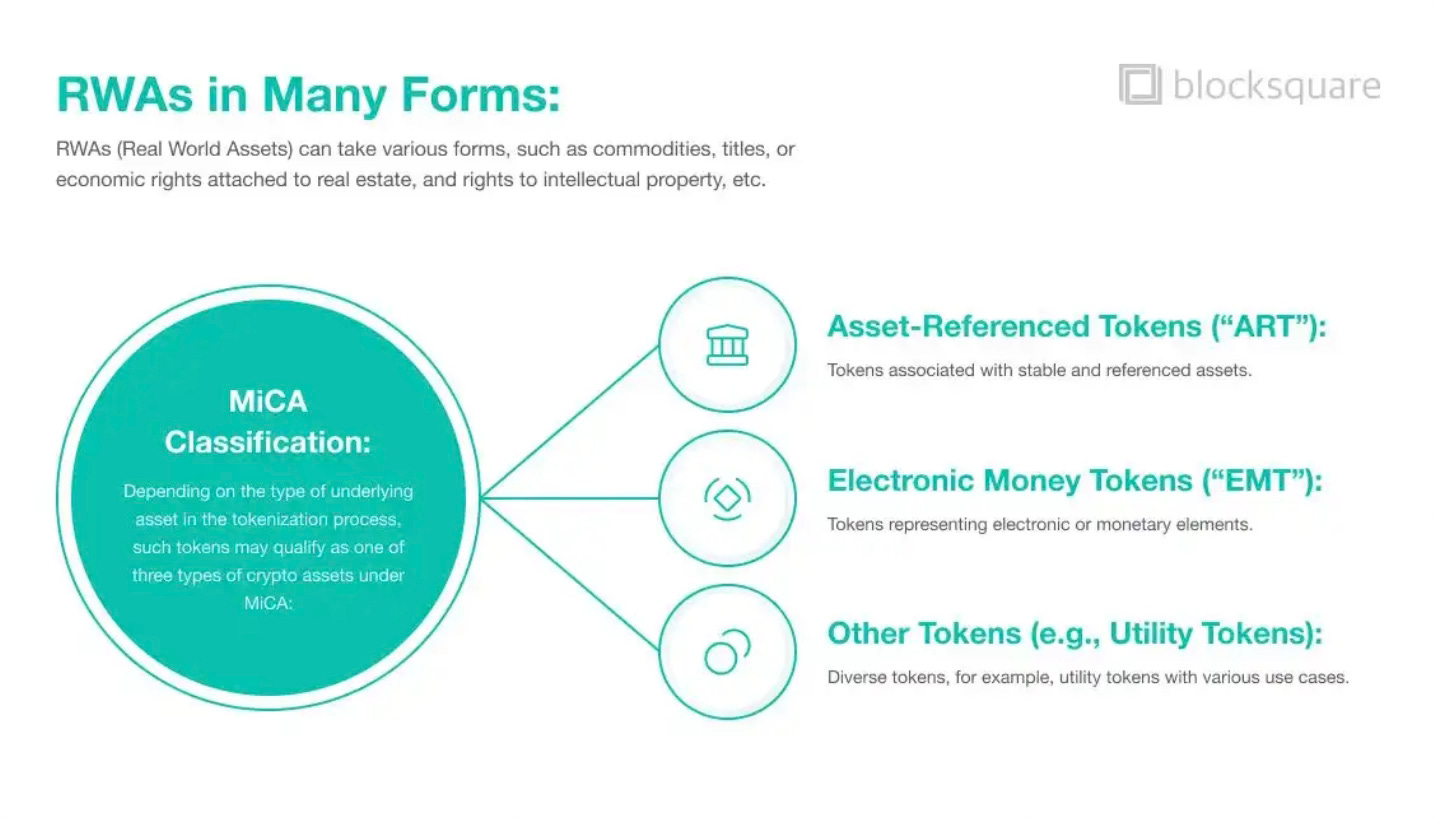

Clearer regulation: Governments could establish straightforward guidelines for crypto assets, reducing the legal grey areas and building investor confidence. In Europe, The Markets in Crypto-Assets Regulation (MiCA) law helps facilitate the tokenisation of real-world assets by providing a regulatory framework that covers crypto-assets, including asset-referenced tokens (ART) and electronic money tokens (EMT).

Better consumer education: Teaching people about blockchain and tokenisation can empower them to spot good opportunities and avoid scams, just like in any other investment scheme out there that is not related to blockchain or cryptocurrency. You don’t throw your money at people or companies that you haven’t first verified. My view is that financial education is the first step as we don’t realise how much we actually don’t know about money, investment, due diligence, etc.

Technological improvements: Faster networks with lower fees could make trading tokens more practical. Improved and secure interoperability between various blockchain platforms is essential. Secure and compliant exchanges where you can trade these tokens are important too.

A Probable Future:

Some uses of tokenisation might stay pretty specialised, like letting people buy small shares of expensive assets like art or high-end properties. But in other cases, it could change how we buy and sell property or make it easier to invest in private businesses that aren't on the stock market. By owning a fraction of the asset, you get some of the same perks as full owners, just in smaller portions. For instance, you might receive part of the income the asset generates (like rent from a property) or have limited rights to use it, all depending on how much you own. This way, investors can earn both from the asset’s growth in value and any income it makes, without having to buy the whole thing.

If the rules around tokenisation get clearer and the conditions are right, it could help more people invest by reducing barriers and giving them access to new opportunities. However, we're not quite there yet because the regulations and systems still need to improve for tokenisation to reach its full potential. The convergence of Artificial Intelligence (AI) and blockchain technology is expected to play an important role in advancing the tokenisation of real-world assets (RWAs), unlocking new opportunities and efficiencies across sectors.

I thought you might want to know what other RWAs could be tokenised in the future:

insurance policies

shares and securities

treasuries government bonds and other treasury securities

equities stocks and other equity instruments

indices, enabling the creation of new financial instruments and investment opportunities

precious metals like gold, silver, and platinum

raw materials like diamonds and other precious stones or minerals

agricultural products like grains, livestock, and other commodities

art and collectibles artwork

Besides real-world assets, there are other types of assets that could be tokenised in the future:

digital assets such as in-game items, virtual currencies, and digital collectibles

intellectual property rights, such as patents, copyrights, and trademarks

financial assets like stocks, bonds, derivatives, and other financial instruments

travel and experiences travel packages, experiences, and other intangible items

personal data such as health records, financial information, or other sensitive information, can be tokenised and represented as digital tokens on a blockchain, providing a secure and transparent means of data management and sharing

Red Flags to Watch Out For

Before investing in any project promising tokenisation, consider these red flags:

Overpromising high returns: If the project promises risk-free returns that seem too good to be true, it usually is. Investment always carries risk, even if the assets are tokenised.

No clear link to blockchain or crypto: Some projects advertise their 'token' but offer no information on how blockchain tech is actually used. Vague buzzwords shouldn't replace real value.

Lack of transparency: Any serious business will have a clear white paper (the document outlining their technology and goals) and a business plan that's easy to verify. Be wary if you can't find these.

Anonymous or unqualified founders: Check the credentials of the team behind the project. If they're hiding behind anonymity or lack relevant expertise, it’s a warning sign. Check what other projects they worked on, how did those projects do, have they successfully delivered results or met their goals in a way that instills confidence in their ability to execute this new project.

The Fine Line Between Innovation and Speculation

Tokenisation promises to democratise investment, but it’s still fraught with challenges. The idea of turning assets into digital tokens holds promise, but there's a fine line between genuine innovation and reckless speculation. As with any new technology, learning the ropes before jumping in is crucial.

Let's stay curious, stay sceptical, and keep our eyes on the real opportunities while leaving the empty promises behind.