The Network Behind the Numbers

Navigating $100K Bitcoin, personal pivots, and other whispers of change

BTC price rise to $100K has everybody buzzing with a mixture of disbelief, wonder, and excitement. Memes are spreading like wildfire across social media and even those who previously dismissed Bitcoin are now leaning in with curiosity. However, Bitcoin price is not what I have in mind for today’s post. I’ll be discussing Bitcoin nodes, their importance in keeping the network decentralised and secure.

But before, I have some news of my own to disclose. You may have noticed that my newsletter hasn't hit your inbox in the past few weeks. There's good reason for that 😊. While most of the time I keep to my weekly publishing schedule, lately it was hard to do so. I recently became part of the managing team for the Algarve Women's Network (AWN), and with it came a new wave of responsibilities, from organising events to building AWN's branding, website, social media presence, and most importantly, growing the community while delivering value. And this is not all: there is yet another thing that I'm preparing (it's all about helping women find purpose and live the life they truly want), but I'll talk about that some other time 😉. Meanwhile, I will continue writing here, although I have to consider whether to maintain the same frequency or go back to fortnightly posts.

Now, we've seen $100K Bitcoin, but will it stay at this level by the end of the year? If I'm honest, I don't know 🙃. Nowadays, you just have to follow global economic trends to have a guess at what will happen to Bitcoin's price. We saw it with US election results, every time bank rates change, etc. Bitcoin used to be the ONE uncorrelated asset, but that's no longer the case, and in part it's due to institutional adoption, among other things.

I wonder if concentrating on price, we forget all about Bitcoin's original purpose: Decentralisation and Being Your Own Bank. Back in 2017, when I was discussing Bitcoin's decentralisation on various conference stages, I was the first to defend it and make the difference between miners and nodes. There was a lot of noise about how Bitcoin was becoming centralised due to concentration of mining farms in China and other parts of the world. I was stating a fact, and I've probably said this here before too: nodes don't need to be miners, and miners are not the only nodes in the Bitcoin blockchain. If you, I, and anyone else actively run a full node on our computers, we are part of the Bitcoin consensus mechanism. Our computers would be running Bitcoin Core software, storing the full blockchain, and validating transactions and blocks against Bitcoin's programmed rules. We would be enforcers of the Bitcoin consensus but would not receive financial rewards.

The greatest misconception is saying that a Bitcoin Node makes money! Not unless that node is a miner! Running a node itself doesn't generate profit, it's a voluntary act of supporting the network's decentralisation and security.

Looking back, 2017 was the peak with a total of 205,546 estimated nodes, but what about today? According to one of the Bitcoin developer’s estimated calculations, as of 4th December 2024, there are roughly 101,777 nodes. The chart below estimates all Bitcoin nodes using the IPv4 internet protocol, counting both public (listening) and private (non-listening) nodes. However, it doesn’t include nodes using other protocols. There are two main internet protocols in use today: IPv4 and its newer version, IPv6. Additionally, networks like Tor use their own protocols for privacy-focused communication. IPv4 is an older internet addressing system that assigns unique numerical addresses to devices so they can communicate online. It’s still widely used today.

Bitcoin Node Count History

The actual node count is pretty hard to nail down accurately and we have several platforms such as Bitnodes.io, that use their own methods to measure Bitcoin nodes, with their live map showing the number of publicly reachable nodes active at any given moment.

Bitcoin Network Live Map

Having nodes in the Bitcoin network is extremely important for decentralisation and security. While miners create new blocks and secure the network through Proof of Work (mining), nodes independently validate those blocks and enforce Bitcoin’s consensus rules. As the block subsidy decreases through halving events, mining will rely entirely on transaction fees, which may not always be sufficient to sustain miners' operations profitably. This could further consolidate mining operations to those with the lowest costs. That’s why a wide distribution of nodes also reduces centralisation risks, as it makes it harder for any single entity to control or censor the network. This balance between nodes and miners is key to Bitcoin’s resilience and decentralised nature.

Amongst Bitcoin validator nodes are also wallet operators and businesses that accept Bitcoin. Wallets and companies like exchanges and payment processors, run nodes to ensure they verify transactions directly from the Bitcoin network instead of relying on a third party, giving users more security and privacy.

The Bitcoin network relies on nodes to ensure decentralisation and security, but in the future, it’s unclear if wallets, miners, and businesses running nodes will be enough. These groups run nodes for their own purposes, like verifying transactions and maintaining trust in their operations, but their motivations are often tied to profit or convenience. If running nodes becomes too costly or complex, fewer may choose to do so, leading to a decline in the total number of nodes. This could make the network more centralised, as only large players with resources, like mining pools or big businesses, might continue running nodes.

Decentralisation relies on ordinary users running nodes too, as they validate the network independently and prevent power from concentrating in a few hands. If fewer individuals run nodes in the future, Bitcoin could lose some of its censorship resistance and trustless nature. While current trends show enough participation, maintaining decentralisation long-term may require better incentives or easier tools to encourage more people to run nodes, not just rely on large entities.

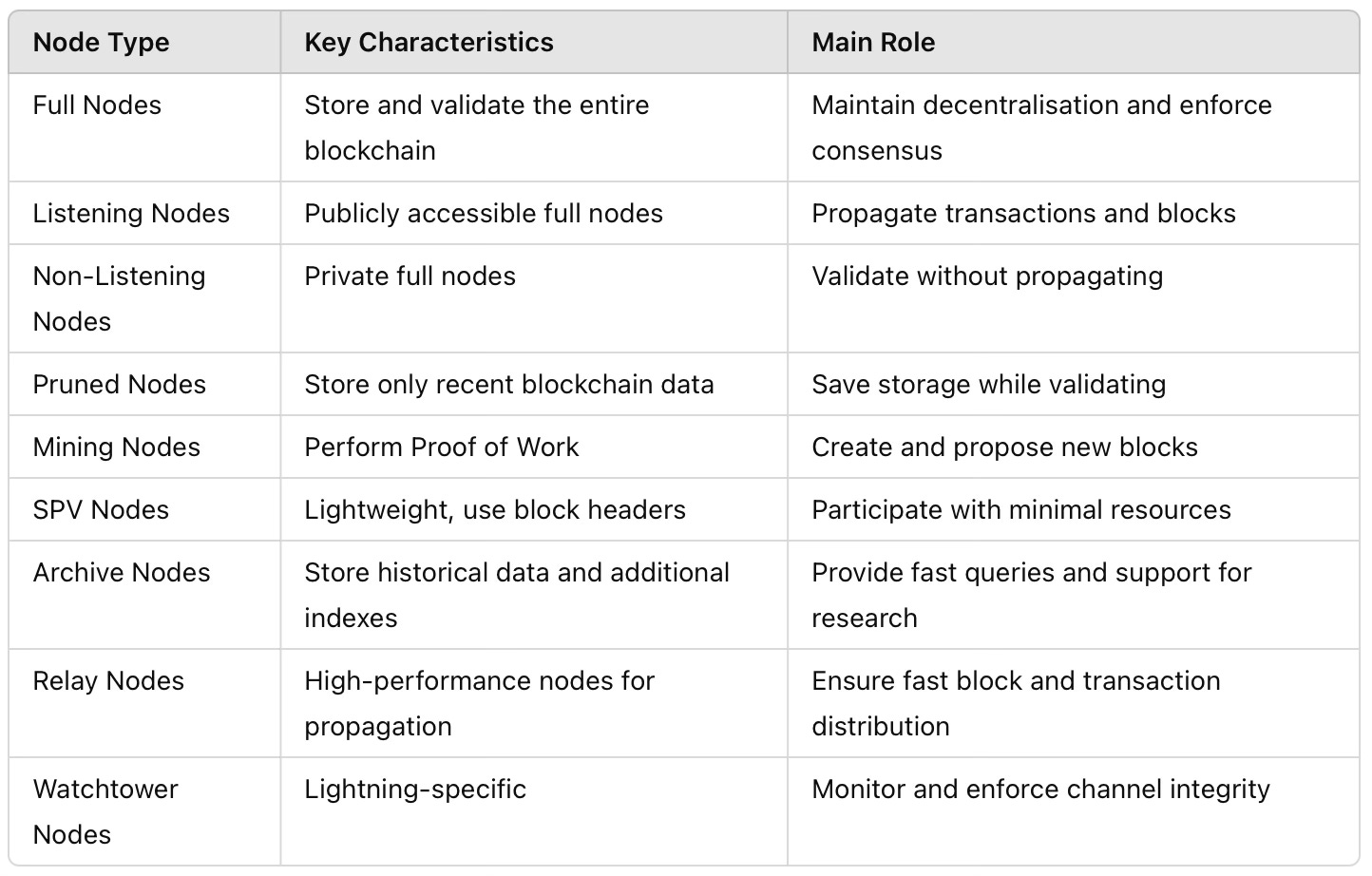

Bitcoin nodes by type

Running nodes could become too costly in the future for a few reasons. As the blockchain grows, storing and processing it requires more disk space, computing power, and bandwidth. For individuals, this might make running a node impractical, especially if their internet or hardware is limited. Without incentives, most people might wonder why they should run a node at all.

Several efforts are underway to make running a Bitcoin node easier so more people can contribute to the network without needing advanced technical skills or expensive equipment. Developers are working on lightweight versions of full nodes (pruned nodes) that reduce the storage and bandwidth needed, making it possible to run a node on a basic computer or even small devices like Raspberry Pi. Tools are also being created to simplify the setup process, offering user-friendly interfaces and guides for non-technical users. Additionally, there’s a push to make nodes more compatible with Tor and other privacy tools, so people can run them securely without exposing their identity.

Here’s what I’d need to run a full node today:

A computer: It doesn’t have to be fancy, but it needs enough processing power to handle the Bitcoin software and blockchain data. Many use desktops, laptops, or small devices like Raspberry Pi. Regardless of the device I choose, I would need it to have 2 GB of RAM to run a Bitcoin full node, but 4 GB or 8GB more is recommended for smoother performance, especially if I’d use the computer for other tasks while running the node. My processor should be at least a dual-core CPU, but an Intel i3 or equivalent, is recommended for faster transaction validation and block synchronisation.

Operating system: Bitcoin Core works on Windows, macOS, and Linux. However, Linux is often preferred because it’s lightweight, reliable, and better suited for long-term operations, especially since I would be running the node on a dedicated device, not my usual computer.

Storage space: I’d need at least 500 GB of free disk space to store the entire Bitcoin blockchain, which grows over time. Think of it as saving a big, ever-expanding file.

Reliable internet connection: A full node constantly downloads and shares data with the Bitcoin network, so I would need an unlimited data plan and a stable connection. Around 200 GB of downloads and 20 GB of uploads per month is typical.

Bitcoin Core software: This is the official software to run a full node. I would need to download and install it, and it manages everything needed to connect to the Bitcoin network. You can find more info here: https://bitcoin.org/en/bitcoin-core/

Patience: The initial download of the blockchain can take days, depending on

internet speed, as it has to verify every transaction from Bitcoin’s beginning.

I get it, if you invest in Bitcoin indirectly through a fund, index, or ETF, you don’t necessarily need to care about running a node because you’re relying on the fund managers to handle exposure to the network. However, understanding the role of nodes is still important. But, if you buy or own Bitcoin directly, understanding and supporting the Bitcoin network becomes more relevant. When you own Bitcoin outright, you rely on the network’s decentralisation and security to protect your money and make sure your transactions are valid. It lets you independently verify transactions and balances, so you don’t have to trust the exchange or other third parties. Nodes are what keep Bitcoin decentralised, secure, and trustworthy, which ultimately supports the value of the asset you’re investing in. If fewer people run nodes and the network becomes more centralised or compromised, it could impact Bitcoin’s integrity and, in turn, its value. While running a node yourself may not be necessary, being aware of how the network operates helps you better evaluate the long-term sustainability of your investment.

So, whether you're a crypto enthusiast or just curious about BTC, understanding Bitcoin's backbone is like knowing how an engine works in a car you love. You don't need to be a mechanic, but a little knowledge goes a long way. Keep learning, stay informed, and remember: in the world of Bitcoin, knowledge isn't just power, it's your passport to a more transparent financial future.

Want to dive deeper? Keep reading, stay curious, and who knows? You might just become the most blockchain-savvy person in your circle. 😊🚀