Can Bitcoin and asset-backed currencies reshape our Financial Future?

The money revolution might be closer than you think

Break of trust in our financial institutions didn't happen overnight. Since 2008, we've watched confidence in traditional banking slowly fade away. Recent years inflation spikes of 8% in the U.S., 211% in Argentina, and 50% in Turkey have made people question if our current financial system can last.

I’ve mentioned before that my financial education didn’t happen in school, but rather in the past 10 years of self-study. And while I’m not a famous economist, I’ve learned enough about how finance world works and I started wondering how much longer can it be sustained. What's emerging in front of us today isn't just new technology. It's a complete rethinking of money itself. The rise of Bitcoin and the growing movement toward asset-backed currencies represent something important: a return to money with real value, combined with digital innovation.

El Salvador adopted Bitcoin as legal tender in 2021, and the results are worth noting. Bitcoin has provided a digital alternative to traditional banking systems, potentially bringing more people into the formal economy. This is particularly important in a country where a significant portion of the population was previously unbanked. In early 2019, an anonymous donor provided a six-figure Bitcoin donation to El Zonte, which helped establish a Bitcoin-based economy. This initiative, known as Bitcoin Beach, aimed to create a circular economy where Bitcoin was used for local transactions. The project supported various community activities, including youth programs and economic aid during the pandemic

Bitcoin does face challenges. Its price can change rapidly, and mining operations use a lot of energy. But the story is changing as 58% of Bitcoin mining now uses renewable energy. El Salvador mines Bitcoin using volcanic energy, while Kenya uses extra hydroelectric power for mining that otherwise would go to waste.

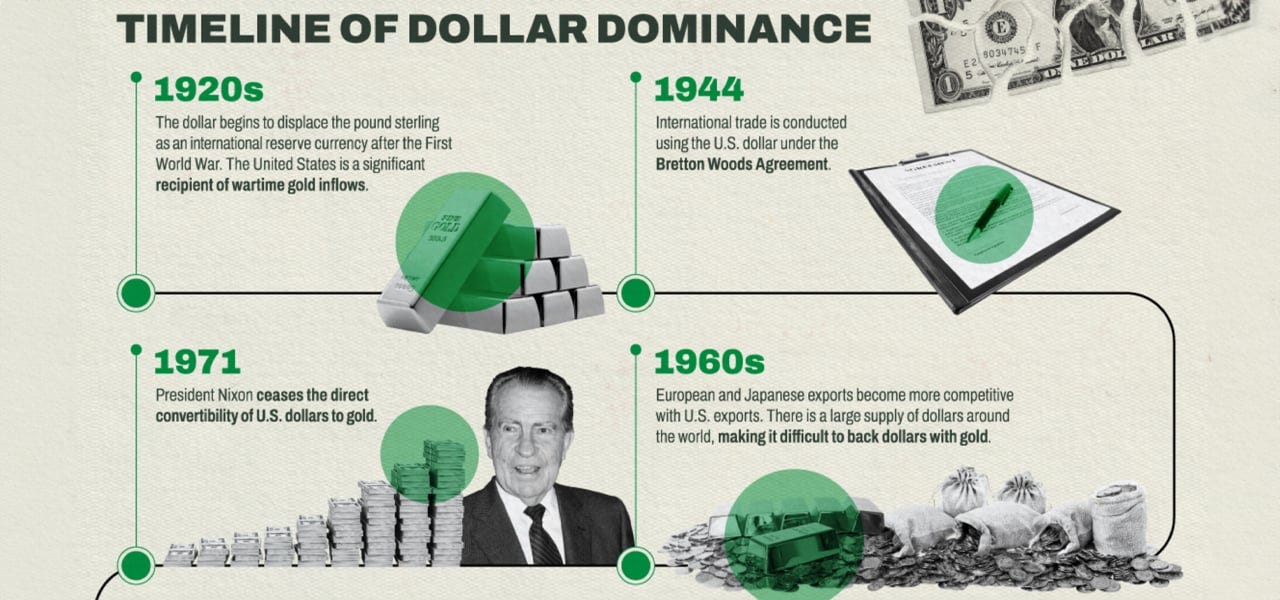

The U.S. dollar has ruled global finance since 1944. But this dominance is now facing serious challenges. Many nations started to question their reliance on a currency that could be used as a political weapon. Also, when the Federal Reserve creates new dollars, many countries, like Nigeria, see their import costs rise and their dollar debts grow.

It’s understandable that the U.S. has a duty towards it’s citizens and their local economy, but their monetary policies have a ripple effect on economies around the world. This realisation has sped up the search for alternatives.

BRICS nations (now expanded to include Egypt, Saudi Arabia, UAE, Ethiopia, and Iran) account for 36% of global GDP. They are looking into creating a common trade currency backed by a basket of commodities, including gold and potentially oil, lithium, or other natural resources to reduce dollar dependency. They are leading global gold buyers, collectively purchasing 1,100 tonnes of gold in 2023. In February 2025, BRICS officials discussed expanding these initiatives, including creating a unified financial messaging system and potentially a new unified currency among member states. And projects like mBridge and BRICS Pay signal a shift toward blockchain-based trade settlements amongst BRICS nations.

Argentina's experience offers another compelling example. With inflation hitting Argentina's annual inflation reached 211.4% in 2023, the highest in 32 years, Argentinians have turned to cryptocurrencies like Bitcoin and USDT (Tether) to combat inflation, with the country having the highest crypto adoption rate in the Western Hemisphere.

The African Development Bank (AfDB) is exploring a mechanism to mitigate currency risk by creating a non-circulating currency backed by a basket of critical commodities. This currency would facilitate financing for clean energy projects by reducing convertibility risks. Participating countries would pledge to trade a portion of their natural resources via a settlements agent. The mechanism aims to lower financing costs for African countries, increase foreign direct investment, and incentivise domestic resource exploration.

Ghana is working on a plan to buy oil using gold, which represents a significant shift away from dollar-denominated transactions. This approach could be seen as a precursor to using resource-backed currencies or digital assets in international trade.

Tether Gold (XAUt) was launched in January 2020 by Tether, the company behind the widely used USDT stablecoin. The primary goal of Tether Gold is to provide a gold-backed digital asset that combines the benefits of blockchain technology with the stability of gold. This allows users to own gold digitally without the need for physical storage or handling.

Growing interest in asset-backed digital currencies (e.g., gold-pegged tokens, CBDCs) and Bitcoin reflects a partial challenge to dollar dominance, particularly among emerging economies. These developments aren't simply a return to the gold standard, which was abandoned in 1971 because it was too rigid. Instead, they reflect a more balanced approach: back currencies with resources, but keep flexibility with digitisation and cryptocurrencies like stablecoins and Bitcoin.

Experts argue that policy-driven financial system fragmentation could cost the global economy $0.6 trillion to $5.7 trillion by 2025, equivalent to up to 5% of global GDP. The economic impact of fragmentation is projected to surpass the 2008 financial crisis and COVID-19 pandemic, with inflation potentially rising by over 5% in high-fragmentation scenarios.

I believe that the way forward isn't about completely replacing the dollar. It's about creating more options and giving people choices. We stand at an important moment in financial history. The established system of centralised control, persistent inflation, and growing inequality is being challenged by alternatives that are decentralised, asset-backed, and (hopefully) more democratic. 63% of financial experts surveyed by the CFA Institute expect the dollar to lose some reserve status within 5–15 years, with a multipolar currency system (e.g., yuan, euro, digital currencies) emerging. A gradual shift away from the dollar would likely cause less disruption than a rapid one. A slow transition allows economies to adapt and adjust to new systems and currencies.

Bitcoin isn't a perfect solution right now, and the transition away from dollar dominance will involve complexities and challenges. However, we can’t deny that Bitcoin and other cryptocurrencies adoption is reducing reliance on traditional banking by offering decentralised financial services and enhancing financial accessibility. Additionally, it contributes to de-dollarisation through alternatives to national currencies and supporting a shift toward a multipolar financial system. A future de-dollarisation could enhance Bitcoin's status as a safe-haven asset, potentially boosting its value and influence in global financial transactions. For example, Fidelity predicts countries and central banks that once avoided Bitcoin will start buying it in 2025.

Many central banks are fighting back, exploring the development of CBDCs as a response to cryptocurrencies. CBDCs could potentially mitigate the impact of cryptocurrencies on monetary policy by providing a digital form of the official currency, but it comes with its own set of troubles, like surveillance and control.

You can find a detailed explanation of CBDCs in one of my past articles below 👇

The IMF and El Salvador situation is yet another example of trying to keep the status quo intact. El Salvador secured a $1.4 billion IMF deal in December 2024 that required limiting Bitcoin policies. The IMF demanded an end to "voluntary Bitcoin accumulation" by December 2025. Despite this, Bukele's government found workarounds, adding 19 BTC to reserves in March 2025 and shifting Bitcoin purchases to quasi-private entities. The IMF remains concerned about fiscal risks from Bitcoin exposure, withholding $800M until El Salvador freezes public-sector Bitcoin holdings.

The world is slowly moving away from relying only on the US dollar. Countries are creating a new financial system that uses many currencies, backed by real things like gold or digital money like Bitcoin. This change is about countries wanting more say in how global money works. They're protecting themselves by spreading their wealth across different currencies, making deals to trade in their own money, and looking at cryptocurrencies as options.

The old system created after World War II is being rebuilt as countries look for better alternatives that fit today's world. What's becoming clear is that flexibility and having different options will matter more than sticking to just one type of money. The future belongs to those who can adapt to this new reality. Will we embrace the opportunity to build a financial system that works for everyone, or stick with outdated models that benefit only a few? Time will tell 😊

Sources:

Cambridge Bitcoin Electricity Consumption Index (2024)

Chainalysis 2023 Global Crypto Adoption Index

Fidelity Digital Assets Report, 2025